2025 Journal

2025-11-10-Mon

Section titled “2025-11-10-Mon”- I met with Hugo Parkinson from Bain re. AI opportunities:

- AI collaborations / have partnerships with OpenAI etc.

- Struggling to keep up with AI consultancy growth

- Didn’t win some worsck because we aren’t good at marketing the capabilities:

- Eng and prod teams don’t have the time.

- They are hunting for people for me.

- Send a paragraph to Hugo re. my expertise and area of focus

- will forward to global head of technology

- Advisory or full time

- Where they play: not interested in being commoditised. Have a team but deploy co-teams. Bain generalists, data scientists, engineers all in at the same time. Change management / connection to business process change.

- Focus on hard stuff.

- Chuck (was CIO of Dell) / Bain Partner

- ET / ERP / systems arch all merged with AI + Data Science

- Do a lot of Private Equity - lots with Advent International(?)

2025-11-13-Thu

Section titled “2025-11-13-Thu”- I met Lee Schuneman re Efekta Advisory

- confirmed I’ll start a limited company; he will kick off HR process.

- confirmed I would be online and they can email me whenever. May need to adjust depending on commitments.

- Sequoia - decided no. Partner was leaving. Liked it but not sure about edu.

- Mike Moran → gave great feedback and now looking at a pivot.

- “It’s a distribution deck, not a product & tech deck”

- not disruptive enough for premier VCs.

- distribution vs. product

- Nick Clegg sounds like he’s on board.

- Marie - Finland prime minister and NGOs is onboard.

- Stefania - head of UNESCO for Education.

- 2 AI guys: Deepak and other - struggling to find time to support.

- Watson Fuels delivered heating oil to Greenworld: 1200 litres / £767.87 #house

2025-11-14-Fri

Section titled “2025-11-14-Fri”- I asked Andrew Horton re. accounting services for Frontier Impact Ltd

- I met George Stainton from Hoxton:

- think through trusts vs. gifting for the boys

- work out our our retirement income needs will be. then back out interim activity to get there (Discounted Gift Trusts, gifting, etc.)

- our goal: long term, put assets to work

- pensions are now the hardest thing to plan for inheritance. now considered inside estate. we’re in a better place because most of wealth is outside pensions and outside UK

- contributions to pensions? haven’t thought about it; depends on employment. can catch up but depends on surplus, etc.

- Waymouth short term goals: 1) simplify 2) get assets back to the UK and put to work 3) minimise cost.

- Phil to send them statements from Fidelity etc. with investment details (ignore cash)

- transfer from US: be in the right currency (GBP). cash is easy (all about currency mgmt). then in the UK what do we do with it? trust planning, pensions, build more wealth?

- if more trust, then work out retirement needs, work out how to get there, then if there’s a buffer then put remainder in a trust.

- can expect 8-10% returns. even with existing assets, likely to have enough - may have to plan for significant IHT liability?

- retirement: much more time to spend money. more travel, holidays, eating out. can be surprisingly expensive. first estimate: current expenses - kids.

- CGT considerations: FIG regime in the UK. built for e.g. returning Brits: 4 year window to crystalize assets. incentive to bring money into the UK. can do clever planning with US low tax rates. maybe get those funds out with as little CGT as possible? wait to use low US tax rates next year, then do FIG next year.

- Waymouth risk profile: broadly, risk adjusted approach. 60-70% percentile on risk? their advice is fairly vanilla on equities (over 10-15 years things go up), fixed income advice more helpful.

- back on 2025 Journal, meet on 2025 Journal.

- next meeting: he will presenting advice - then we get 2 weeks to assess and read. then a Q&A then after that a decision.

- Phil to complete the Hoxton risk assessment

- Phil to check if I can transfer GBP from Fidelity, or if I need to convert back to USD first

2025-11-15-Sat

Section titled “2025-11-15-Sat”2025-11-16-Sun

Section titled “2025-11-16-Sun”2025-11-17-Mon

Section titled “2025-11-17-Mon”- I asked Oege de Moor about introduction to Northzone Ventures.

- I asked David Soria Parra for introduction to General Catalyst and Sequoia.

- I asked Tom Hulme for in person meeting.

- I asked Miles Brundage for a catch up call.

- I booked Nicholas Lovell on 2025 Journal for advice on Frontier Impact Ltd.

- I met Michiel Kotting from Northzone Ventures about working with him. Positive.

- I told Lee Schuneman that I’d review investor feedback and help him change the Efekta pitch deck.

- had a productive day, following the Sunsama plan.

2025-11-18-Tue

Section titled “2025-11-18-Tue”- Contact James Hamilton’s accountant.

- I registered Frontier Impact Ltd using 1stformations.co.uk! 🎉

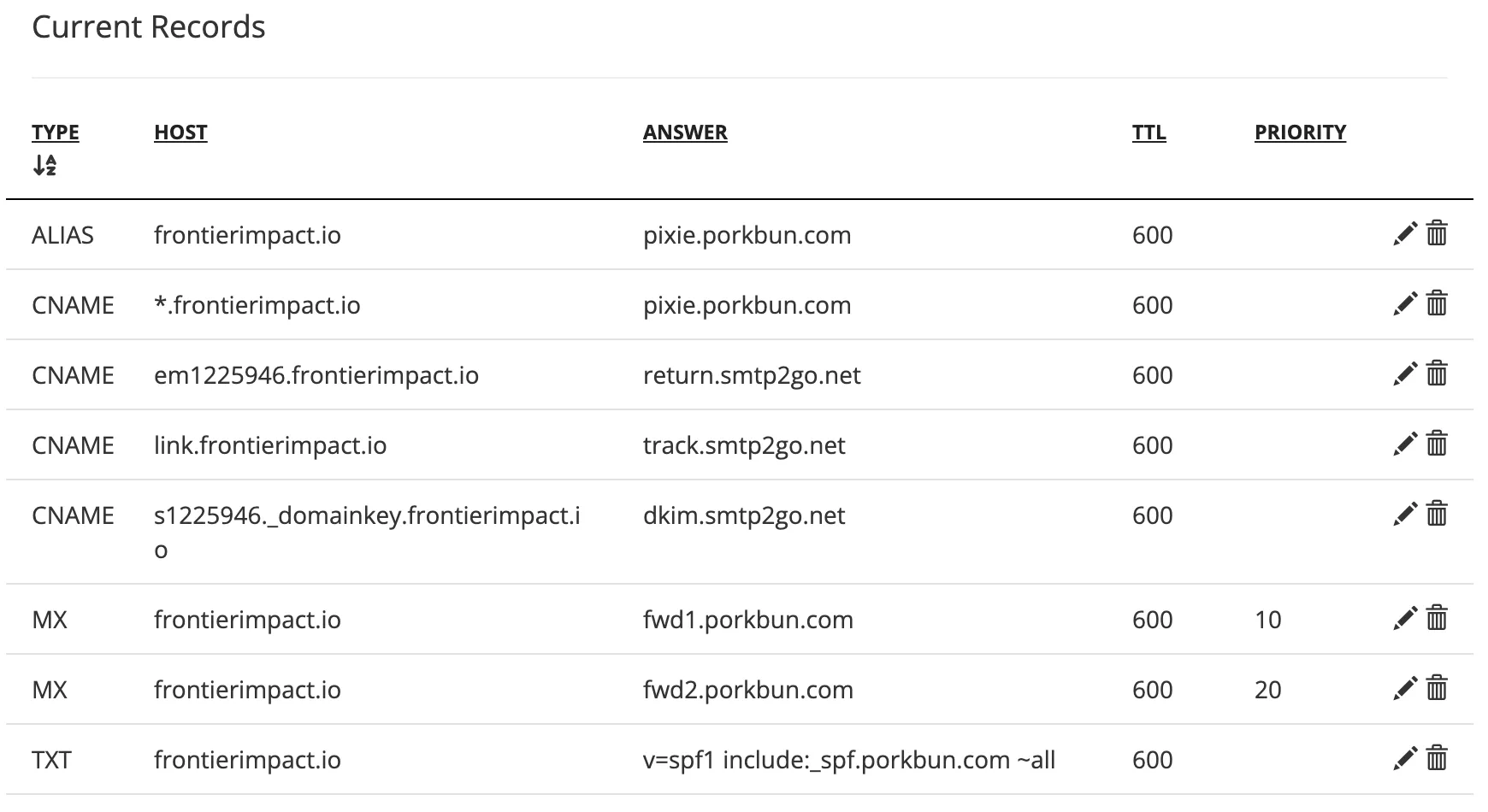

- I registered the frontierimpact.io domain using Porkbun.

2025-11-19-Wed

Section titled “2025-11-19-Wed”- I booked Julie Bjune from Efekta for a meeting 2025 Journal or soon after to finalise Frontier Impact Ltd contract.

- I met Kyunghyun Cho from Genentech about startup advice and what’s interesting:

- Focus on Differentiation: It’s nice but difficult for founders to avoid the common trap of merely stating they will automate things. It’s easy for startups to say they’re going to do these wonderful things (e.g., automate 80% of tasks, from robotics to biologists’ wet labs), but if everyone can say that, why will anyone choose you?

- Proving Value: The key challenge is that there is no reason to know which startup is providing value.

- The Commodity Trap: A small robotics startup talking to Genentech (where KC is a member) was planning to talk about setting up the service first, and only after securing Genentech’s business, getting a subscriber. This approach leads to commodities!

- Guarantees Over Tech: Startups don’t need the AI tech itself; the question is: Can they actually lower cost? The real value is: Can they build a service with some strong guarantee? How do you define and guarantee that?

- For example, can the robot work as well as or better than the status quo?

- Liability and Service Models: Instead of selling an expensive robot, then having to hire someone to make sure it works for 3 years (babysit robot), focus on guarantees and liability.

- Regulation as an Enabler: Kysenia at Chicago Booth (working on AI for Insurance) realized that these issues are very easy to solve if the regulation is on the product. Insurance companies will underwrite, and the premium will decide the danger.

- “What’s On Top”: Doing something is so easy. What’s on top is the differentiator.

- LLM Control within Enterprises: Within Genentech, people ingest new LLMs, test them, then build new retention systems. A persistent issue is that however you tell Gemini 3 not to call external resources, it always calls Google Search.

- Foundation Model Infra: If we think that this kind of LLM is the real infrastructure, there could be a way to prevent products on top of the foundation models—perhaps through bundling?

- Learning to Learn (Meta-Learning):

- The Problem: The standard deviation () can be calculated from a sample, but there is no universal unbiased estimator for the population standard deviation.

- The Solution: Train a neural network (NN) to recover population standard deviation from a sample. It works and generalises, providing an almost unbiased estimator.

- Mutual Information (MI) Estimation:

- The Problem: In high-dimensional space, it is never satisfactory to either minimize or maximize mutual information between two independent variables.

- The Solution: ETH Zurich created a set of benchmark datasets. They trained 1 NN that takes 2 samples of any size and predicts mutual information. This solution works, and Sequoia could not come up with a better estimator. This suggests distribution matters, but the NN is finding something.

- Algorithm Learning: Going from algorithm design to algorithm learning opens up lots of interesting challenges with this worldview.

- Sim-to-Real Gap:

- Talked to Nvidia folks about their amazing real-time rendering in 2018. The policy they trained in the simulator didn’t generalize to the real world.

- The Mistake: They made the simulations too realistic and lost variance. It is hard to make high fidelity with high variance.

- The Fix: Need high variance. Sacrifice fidelity and retain fidelity for high generalization to the real world.

- KC offered to make an intro to Edward Grefenstette at Google DeepMind.

- I asked Alex Momeni for a meeting to learn about General Catalyst and potential opportunities to work together.

2025-11-20-Thu

Section titled “2025-11-20-Thu”- I sent Lee Schuneman and Steve Hodges my thoughts on the new ChatGPT for Teachers announcement.

2025-11-21-Fri

Section titled “2025-11-21-Fri”2025-11-22-Sat

Section titled “2025-11-22-Sat”2025-11-23-Sun

Section titled “2025-11-23-Sun”- Frontier Impact Ltd was incorporated today!

2025-11-24-Mon

Section titled “2025-11-24-Mon”- I met with Nicholas Lovell re. consulting advice for Frontier Impact Ltd

- I met with Junaid Bajwa re. the AI landscape in the UK

- what are my superpowers? I am a translator between invention and commercial success.

- ai for science - important!

- +447779301474

- physician / scientist (GP)

- big tech /

- Microsoft Research until a year ago

- Flagship Pioneering.

- msr / desney / health care next w/ peter / then desney.

- trusted, viable health-centered AI

- no move to seattle given family

- Flagship Pioneering: build co’s, raise mone, then invests in its own research, 9500 scientists, mostly in boston.

- figure out globalization and base in the UK.

- also in singapore but diff.

- 6-8 cos per year, 70-80 % ai related.

- Pioneering Intelligence → ai focus. some jobs there.

- network useful!

- know vc and pe people → send blurb to Junaid

- send blurb to someone else! (search - Jeppe?)

- MHRA - chief digital transformation officer. report to ceo. global / national role.

- https://www.civilservicejobs.service.gov.uk/csr/jobs.cgi?jcode=1974144

- help shape an org, biopharma / med tech / etc.

- chief exec is a good guy. used to be a deputy cto of St Guy’s

- UCLH - chief digital / chief transformational officer.

- send resume to Junaid.

- non-exec and board roles?

- Opportunities:

- https://www.civilservicejobs.service.gov.uk/csr/jobs.cgi?jcode=1974144

- https://www.civilservicejobs.service.gov.uk/csr/jobs.cgi?jcode=1974144

- https://www.gov.uk/government/groups/national-commission-into-the-regulation-of-ai-in-healthcare

- https://www.perplexity.ai/search/pioneering-intelligence-flagsh-E7TUshOoTzWyJV09D0rnDQ

- https://www.linkedin.com/posts/junaidbajwa_flagshippioneering-lifesciences-biotech-activity-7398744723911237632-b6_g?utm_source=share&utm_medium=member_desktop&rcm=ACoAAATbEIgBrrHc7r6m68qdrd5GoYhvq_svfx8

- I met with Andrew Sweet from Rockefeller Foundation

- Eric Schmidt’s team

- help organise the team

- advisor

- partnerships with OpenAI / Stargate / advisor to him.

- one of the things that’s missing is somebody with capabilities

- ngo review → hard for him to say that’s great → gap of technical capability

- that’s going to work / not going to work.

- launched big partnerships in 3 last weeks.

- close to Bill Gates / lives in London /

- laid the foundation for a lot of the digital infra / 30km of fiber.

- AI factory w/ Nvidia in SOuth Africa

- connect with Jaap from Nvidia

- is there a role / given demands internally to do more / similar to do startups / help with them / advise the non-profits / kick the tires on the team.

- certainly dig into it a little more. 2026 → what he had in mind → when there are proposals from an organization / joining calls / reviewing things / help non-profit partners are inspired but need AI thought partner to help them make more impact. right now, development resources are getting smaller.

- thought partner to the program teams → global agri and global health → program teams want to help their own companies adopt AI

- Internal AI innovation fund (idea) → have skin in the game → they put $200k in and andrew helps with a technical partner.

- Connection to Raj has trust and they can move quickly.

2025-11-25-Tue

Section titled “2025-11-25-Tue”- I met with Adam Green and Hana Griffin (financial planner) and Janette Saxer (US specialist), at Cazenove Capital:

- UK “FIG” scheme: looks like you need to be 10 years continuous outside the UK and maybe not pay UK taxes during that time?

- Fidelity may not want to manage the 401(k) with us outside the US; Janette Saxer has recommendations for UK companies that can take this on.

- Fidelity can be slow to transfer shares.

- Things that are tax-advantageous in the US may not be tax-advantageous in the UK.

- Need to calculate the cost basis for the different Fidelity accounts, including cash-based ones, and determine what they are in £, and then send this to Adam.

- Leave the Has as it is.

- Cazenove’s initial thoughts: they’ll set up $ and £ accounts, a separate holding / non-trading execution account while we repatriate.

- We will tidy up all of our ISAs and consider them long-term/high-risk investments, probably full equity investments.

- UK pensions get tidied up. Cazenove will prepare a Letter of Authority to allow them to take a look at the pension details and then provide recommendations on next steps.

- Options for the pension include transferring to Cazenove’s own SIPP pension: roughly a 1% fee, but can all be tidied up. Note: pensions are always sole (separate, not joint) and allow you to make taxation contributions, especially even if there is relatively modest income, like with Sa’s counselling.

- Phil to send the ISA details to Adam.

- Looking at the Cazenove funds: relatively low-cost funds, ranging from boring to high growth. The entry fee is about in each name. After that, some more creative solutions can present themselves. I think the rates were about -. In the interim, the execution-only account has a custody fee, so we should not keep things in there longer than we possibly need to, not only earning any returns.

- There are some options within those Cazenove family funds, even the four broad buckets, and there are some liquidity funds and cash funds that are getting a baseline half a percent below the Bank of England base rate, but others perhaps base rate but with a fee.

2025-11-26-Wed

Section titled “2025-11-26-Wed”- Frontier Impact Ltd signed its 1st client contract! 🎉 3 month statement of work with Northzone Ventures. 4 days/month, £10k/month → daily rate of £2500.

- I met with Julie Bjune at Efekta:

- they’re rolling out AI features. good feedback in b2b. b2s - doing well in latam. getting pilots in other parts of the world.

- what is unique?! and is it usable and worth ti? business fundamentals!

- re. Frontier Impact Ltd: will have a standard Efekta contract with SOW appendix

2025-11-27-Thu

Section titled “2025-11-27-Thu”- Created the Frontier Impact Ltd website (Obsidian → Quartz 4 → GitHub → Cloudflare Pages). Signed up for Cloudflare.

- I purchased professional indemnity / public liability / legal insurance for Frontier Impact Ltd from Simply Business:

- Policy number: CHPR5299167XB

- Start date: 01/12/2025

| Business name | Frontier Impact Ltd |

| Policy number | CHPR5299167XB |

| Insurer | Chiswell |

| Total cost | £237.55 |

| Start date | 01/12/2025 |

2025-11-28-Fri

Section titled “2025-11-28-Fri”- Confirmation from Hugo Parkinson that he’d arrange a meeting with his CTO colleague before 2025 Journal

- I asked Chris Bishop for a catchup to discuss Microsoft AI for Science.

- I booked time with Dylan Collins to meet on 2025 Journal (intro from Nicholas Lovell)

- I added professional insurance to Frontier Impact Ltd’s expenses.

- I sent Junaid Bajwa my CV and conference bio.

- I fixed my email settings for Frontier Impact Ltd after moving the https://frontierimpact.io domain to use Cloudflare’s name servers.

2025-11-29-Sat

Section titled “2025-11-29-Sat”2025-11-30-Sun

Section titled “2025-11-30-Sun”2025-12-01-Mon

Section titled “2025-12-01-Mon”- Had a good morning clearing the garage with Sa.

- I arranged a meeting with Chris Bishop on 2025 Journal.

- I asked Edward Grefenstette for a call to discuss potential opportunities at GDM.

- Good catch up with Pete Munford re.

Highlights

Section titled “Highlights”- Reply to Ishita about meeting 3/12 (on Messages on phone) · Sunsama

- reply to Ed Clark · Sunsama

- Book train tickets for next week · Sunsama

- Phil / Pete catch up · Google Calendar

2025-12-02-Tue

Section titled “2025-12-02-Tue”- Sent a note to Elena Pantazi to get started at Northzone Ventures.

- Had a call with Ralf Gulde at Sereact AI to provide advice on how to approach infra deals with CSPs.

- Asked David Bray to check out a leak in the Greenworld hot water tank.

2025-12-03-Wed

Section titled “2025-12-03-Wed”2025-12-04-Thu

Section titled “2025-12-04-Thu”2025-12-05-Fri

Section titled “2025-12-05-Fri”- Had a call with Chuck Whitten (Global Head of Bain & Company’s digital capabilities → agreed to get an intro to his EMEA head

- spending time re-introducing Bain into the technology space (traditionally strategy and management consulting)

- Option 1: join full time (not for me)

- Option 2: Bain advisory network - heavily commercial, traditionally. Different models. Some more with technical teams. Biggest value is staring down a bank and talking about creating value. Episodic vs. sustained work? Bain is well-respected and a great brand.

2025-12-06-Sat

Section titled “2025-12-06-Sat”2025-12-07-Sun

Section titled “2025-12-07-Sun”2025-12-08-Mon

Section titled “2025-12-08-Mon”- I emailed Ashish Vaswani to offer him congratulations on the Essential AI work and give him an update on my work.

- Call with Stephanie Bell from Partnership on AI:

- Leila Ramath - Warburg Pincus - head of sustainability - Ownership Works

- I had a great discussion with Stephanie about including existing company experts in the process of developing new AI tools.

- I talked about the value of implicit knowledge in expert brains, stating that people plus AI should be the outcome we’re looking for.

- It will be apparent that stakeholders, including model builders, should be aligned to make this outcome happen.

- I had a discussion comparing Amazon versus Toyota and their approaches to improvement.

- Will you trust the process? or Would you trust the people to improve the process?

- I talked of unionization and what role that plays.

- I talked of showing, is this really the way that businesses will capture the value of AI integrated into business process change?

- 10:43: Runway launched Gen-4.5, a new text-to-video model that generates high-definition clips from written prompts specifying motion and action.

- 10:44: Black Forest Labs raised 3.25 billion valuation, co-led by Salesforce Ventures and Anjney Midha (AMP), with participation from a16z, Nvidia, Northzone, Creandum, Earlybird VC, BroadLight Capital, General Catalyst, Temasek, Bain Capital Ventures, Air Street Capital, Visionaries Club, Canva, and Figma Ventures.

- 10:53: customers don’t buy benchmarks; they buy solutions.

- 10:54: In less than 12 months, reasoning-optimised models have surged from negligible to over 50% of all token volume. Consequently, average prompt lengths have quadrupled to over 6,000 tokens, while completion lengths have tripled. The insight here is that users aren’t becoming more verbose; the systems are

- 10:59: Ecosystem economics: OpenRouter’s new study and dashboards sparked takes that “coding is the killer app” (verifiable feedback loops; huge token demand) @swyx. Data points: reasoning models now exceed 50% of OpenRouter usage, and Chinese‑trained closed models drove a large share of traffic (DeepSeek, Qwen3, Kimi K2, GLM) while open‑weights token use plateaued @scaling01 @scaling01. Market is bifurcating: premium models dominate high‑stakes coding; cheap/open models take volume in roleplay/creative @maximelabonne.

- 11:00: Kling upgrades across the stack: Kling Video 2.6 hit the Video Arena as their first model with native, in‑sync audio (speech, SFX, ambience) @arena. Kling O1’s “Element/Subject Library” adds persistent subject memory and consistency, with before/after templates and credits giveaways during launch week elements before/after and integrations via Vmake Agent @VmakeAI and TapNow editing @TapNow_arxiv.org -

- Runway Gen‑4.5 “Whisper Thunder” highlights fine‑grained aesthetic control for world‑building @runwayml. Concurrent research drops include Light‑X (controllable 4D video rendering; viewpoint + illumination) paper/code, BulletTime (decoupled time/camera control) @_akhaliq, and Live Avatar Streaming (real‑time, infinite‑length audio‑driven avatars) @_akhaliq.

Massive TTS update: Alibaba launched Qwen3‑TTS (11‑27 build) with 49+ voices, 10 languages plus Chinese dialects, and highly natural prosody, with realtime and offline APIs and demos on HF/ModelScope @Alibaba_Qwen.

Gemini 3 Pro multimodal: Google highlights “derendering” complex docs to HTML/LaTeX, screen understanding for computer agents, spatial trajectory gen (robotics/XR), and high‑FPS video analysis with “thinking” mode @googleaidevs.

- 11:02: Anthropic Study Finds Most Workers Use AI Daily, but 69 Percent Hide It at Work (Activity: 542): A study by Anthropic surveyed 1,250 professionals, finding that 86% of workers believe AI enhances productivity, yet 69% feel stigmatized for using it at work.

- 11:03: Universal Programmatic Tool Calling Slashes Tokens: A Hugging Face user released a model-agnostic tool orchestrator that implements Anthropic’s Programmatic Tool Calling pattern, allowing any LLM to emit Rhai scripts which orchestrate tools, detailed in the repo Brainwires/tool-orchestrator and Anthropic’s docs at token-efficient tool use. Benchmarks in the project and its YouTube walkthrough claim 97–99% token reduction versus naive sequential tool calls, with the orchestrator running in sandboxed Rust/WebAssembly and staying independent of any particular LLM vendor.

- 11:28: Learning from OpenAI’s FDE Playbook This week I had a conversation with @colintjarvis who leads Forward Deployed Engineering at OpenAI. Alongside Palantir, OpenAI is doing FDE work at remarkable scale – engagements that target tens of millions to hundreds of millions in customer value, sometimes reaching into the low billions. Colin shared several principles that have guided their approach: Start with genuinely high-stakes problems. The companies that succeed with Generative AI don’t pick edge cases on the periphery of their business. Morgan Stanley deployed GPT-4 across their wealth management practice—one of their largest business units. The semiconductor company OpenAI works with asked them to tackle the biggest sources of waste across their entire value chain. Build trust through iteration, not just technical excellence. With Morgan Stanley, the core technical pipeline was working within six to eight weeks. But it took six months of pilots, evals, and iteration before the wealth advisors trusted it enough to use it with their clients. The outcome: 98% adoption and a 3x increase in research report usage. Use eval-driven development. Every piece of LLM-written code isn’t done until you have a set of evals that verify its efficacy. This creates the foundation for trust and for handing off to internal teams once the FDE engagement ends. Trade off determinism and probabilism deliberately. Use LLMs for what they’re best at—handling nuance and complexity. But wrap them with deterministic guardrails for the things that must be right 100% of the time.

- Had a call with Chris Bishop at Microsoft Research; agreed to have a 3 month consulting project starting January 2025. Open ended Project but broadly focused on coming up with a plan for how AI for Science at Microsoft gets commercialised.

- Call with Ishita Sinha: she’s moving into the AI and business transformation space and also doing executive coaching from the New Year which he hopes will be a long time gig. Moved back from the US to the UK a couple of years ago and needs to help with aging parents item good suggestions for who to contact will reconnect in the New Year in person hopefully an old Windsor where she has a house.

- I reviewed the Efekta contractor agreement and added my details and sent it back to Julie Bjune.

- I had a call with Jaideep Sarkar from Brackett AI - https://brackett.ai/

- after Sales Intelligence experience at Microsoft → moved to Kritio to do similar work (ML models in production) - then moved to a fraud detection startup (2 years), was at SambaNova

- his wife works at Microsoft Research - currently works with MSR in Cambridge

- co-founder was at Microsoft. computer vision expert. also cofounder from Amazon

- currently pre-seed: decided to hire. 7 people new. hustling in India.

- 2 US investors (Vocal Ventures (?) and HeavyBit) - started mid-August

- llms fail on business context → lots of companies doing take in a receipt and make a payment → but all companies have edge cases → can’t be UiPath to automate workflow → can be authorable easily. can understand semantically - need to understand last mile context.

- translate llm output into a form that makes sense for the business context.

- multimodality. agents can see, etc…

- Umesh Madan is a mentor to Brackett AI.

- Ashish Vaswani is a mentor.

- Old consultant playbooks are irrelevant → opportunity for a better playbook from Frontier Impact Ltd

- I sent Frontier Impact Ltd details to Sarah Nightingale at Microsoft to start supplier setup.

- Call with Andrew Horton re. potential accounting support for Frontier Impact Ltd:

- Call with Irfan Verjee at IBM: discussion of organizations’ AI adoption readiness, etc.

- investment factor should be AI maturity

- Call with Naseem Moumene, Alessandro De Benedetti, Markus Gleim from Northzone Ventures re. potential investment in Solve AI. Discussed focus on implementation of business processes, beach head with SAP, but concerns about getting squeezed between model capabilities and systems-of-record capabilities.

- Signed the Efekta contacting agreement.

- Elena Pantazi introduced me to Ben Dixon at Sona Technologies re. advisory work.

- Junaid Bajwa is going to introduce me to Claire O’Connell (Chief Information Officer @ Check) re. a healthcare delivery / AI solution.

- Update from Sarah Holzman at Google DeepMind: her sync with Adrian Bolton delayed until mid-Jan. Check in then.

- Email from Lucky Vidmar at Microsoft about potentially being called in for a deposition in New York Times / AI litigation. He introduced me to Jared Briant at Faegre Drinker (outside counsel) - contacted him for an introductory call. Need to understand what my options are.

- Emailed with Florian Mueller @ Bain re. setting up a call. Likely new year.

- Call with Ben Dixon from Sona Technologies:

- Ben Dixon is a software engineer near Cambridge, worked in management consulting and tech startups, and co-founded Sona with two others

- Sona started as an “Uber for retail workers” focusing on flexible labor

- Ended up managing 10,000 people as part of a business with no margin

- As companies wanted better data solutions, Sona built a new product with the same tech stack from Scratch for management and workforce management

- Focused on the same customers to avoid being subscale; solution is configurable but not as complicated as Workday, targeting hospitality and social care sectors

- Sona has built a good data foundation to support AI implementation

- Primarily serving UK customers; first US customer goes live January 5th for workflows and manual agents

- AI Applications:

- Restaurant managers: AI analyzes behaviors for improved performance to help the 80% of managers learn from the top 20%. Example: preventing chicken restaurants from running out of chicken through better decision-making

- Chatting with data: Similar to Power BI but simpler

- Workflow augmentation: Voice agents or coaching managers through HR processes

- Broad theme: bringing the right information to the right people, then supporting action

- Implementation & Results:

- Implementation normally takes six months, improvements visible within 12 months

- Complex and expensive to set up: costs around 1M for the deal itself

- Focused on essential but “boring” areas like payroll and compliance, often last to be modernized

- Sona is the sole interface for most employees, making it a critical channel for adding features

- For 1% EBITDA cost, they see 3% EBITDA return with continuous year-over-year improvement

- Follow-up:

- Will discuss structure of modern teams and service area of software engineers (not simply about lines of code)

- Plan to do more experiments and elaborate further in January

- Call with Jared Briant at Faegre Drinker re. deposition options in New York Times suit.

- It is unsurprising to be asked for a deposition, as the case is in the deposition stage. Sent out approximately 40 requests for depositions, having handled 100 total in the entire case. 10 are from Microsoft, with perhaps 20 to 25 remaining.

- The core issue is the use of copyrighted materials: Is it fair use / what are Microsoft’s control or transitory benefits? Many depositions are scheduled for January and February, including those of individuals who have left Microsoft since the incidents under discussion.

- A discussion was held to structure a deposition. They are offering to represent me at Microsoft’s cost, without the need for separate counsel.

- As I am not a party to the suit, the process differs from that in the US; they cannot serve me a subpoena directly there.

- This can proceed in two ways:

- I can agree to the deposition, either in London or by flying in.

- I can decline, stating I don’t want to do this. If they wish to proceed, the plaintiffs could then send a letter of request to a US court, which would be transmitted to a UK court for a decision.

- This formal process is feasible but time-consuming. It sounds like they aim to conclude this by the end of February. Given the unlikelihood that I possess novel information and the time pressure, the clock may run out.

- They confirmed their representation, and the next step is for them to send their engagement letter.